On April 30 2024, the European Commission released the eagerly awaited results of the first European Hydrogen Auction, containing 132 bids across 13 European countries. We’ve taken a deep dive into the data to better understand the implications. Up next, we discuss the key aspects of these results.

The selected projects, spread across diverse geographic locations in Europe, will benefit a total of nearly €720 million in aid from the Innovation Fund. This will support the addition of 1,500 MW in new electrolyzers, generating 1.58 million tons of renewable hydrogen over the next ten years—an implementation expected to cut over 10,000 kt of CO2 emissions.

Highlights of the first European hydrogen auction

A standout feature of this first European hydrogen auction results is the narrow bid price range of 0.37 to 0.48€/kg among the awarded companies, with grants from the Innovation Fund ranging between €8 million and €245 million. This means that the awarded energy companies, applied for lower subsidies than anticipated, implying that the off-takers to whom they are selling, are paying for a larger fraction of the cost of production.

To analyze these figures, first, we must consider the average price for gray hydrogen, approximately 1.98 €/kg². The average Levelized Cost of Hydrogen (LCOH) in the auction was 8.36 €/kg, with Greece recording the lowest country average at 5.3 €/kg.

Based on this, it can be understood that the awarded projects have deals with off-takers that are willing to pay a higher price per kilogram of green hydrogen than what they pay for gray hydrogen. This could be an important positive signpost for the renewable hydrogen industry, that gives a strong signal to the business developers about the possibility of creating commercial agreements with the current range for LCOH.

Further reading: Explaining the delegated acts for renewable hydrogen

Further reading: How to prepare a competitive proposal for the European Hydrogen Bank auction

However, it’s important to remain pragmatic. This small sample may not fully represent the broader industry trends but rather highlights the initiatives of innovators or early adopters within the European Renewable Hydrogen sector.

The assumption that subsidies would bridge the price gap did not hold for the auction winners. Nonetheless, the average bid price across all projects was 1.86 €/kg, lending some support to the initial hypothesis that the off-taker willingness to pay would not deviate too much from what they are currently paying for gray hydrogen. It is important to highlight that there is not sufficient data for a more detailed statistical analysis at the moment.

Another noteworthy point is the geographical distribution of awarded projects, with Spain and Portugal securing five of the seven spots, while Finland and Norway claimed the remaining two. However, the firms that own the projects come from Spain, Portugal, Finland, Germany, Denmark, and the Netherlands, and they can be categorized as green energy developers, vertically integrated gas and oil, energy infrastructure companies, fertilizers producers, and hydrogen developers companies. So, it seems to be the case that there is a certain leverage for particular regions to locate these projects. Nevertheless, actors from all over Europe are getting involved in these opportunities.

Bids Segmentation by Country

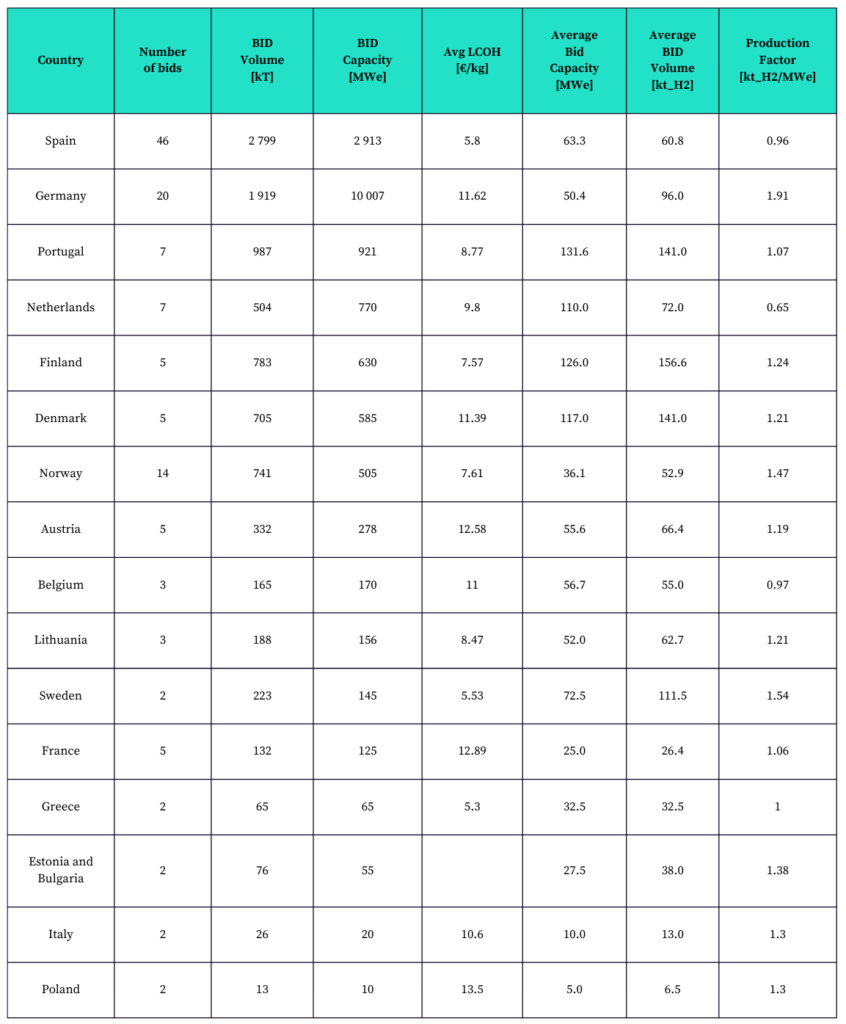

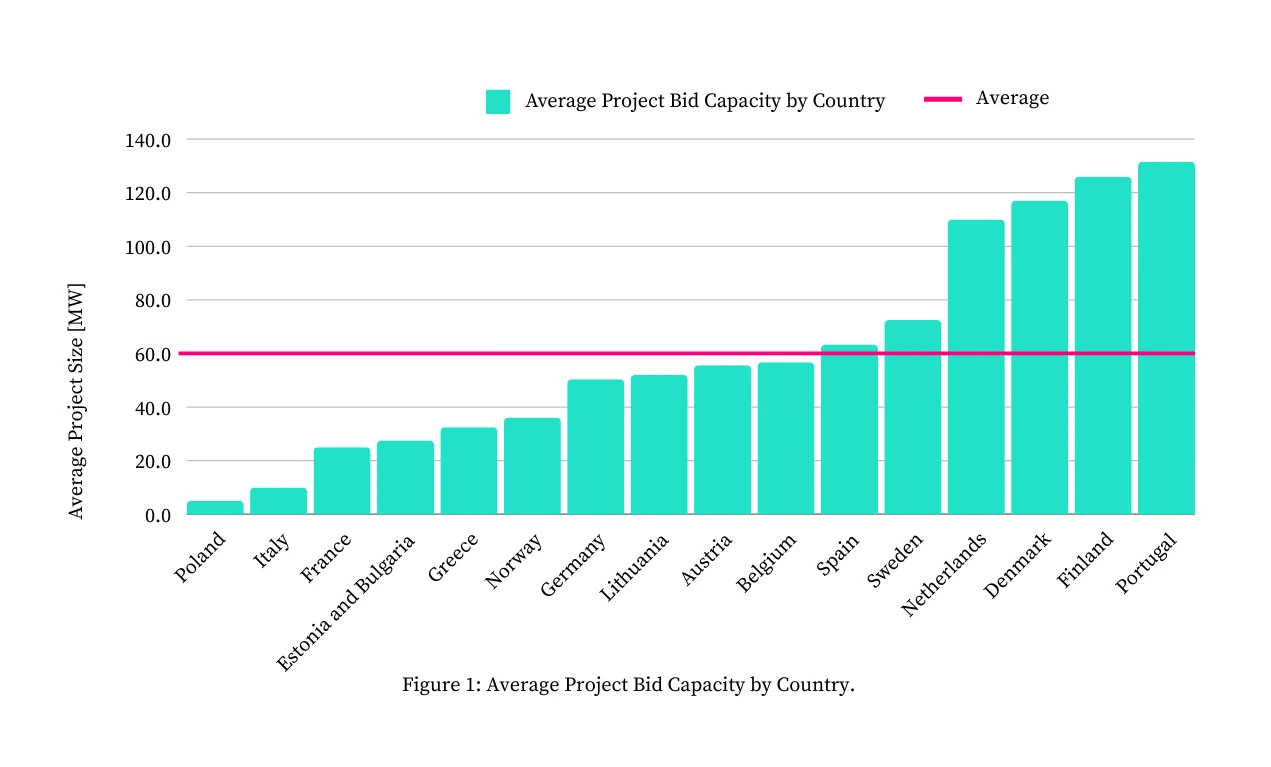

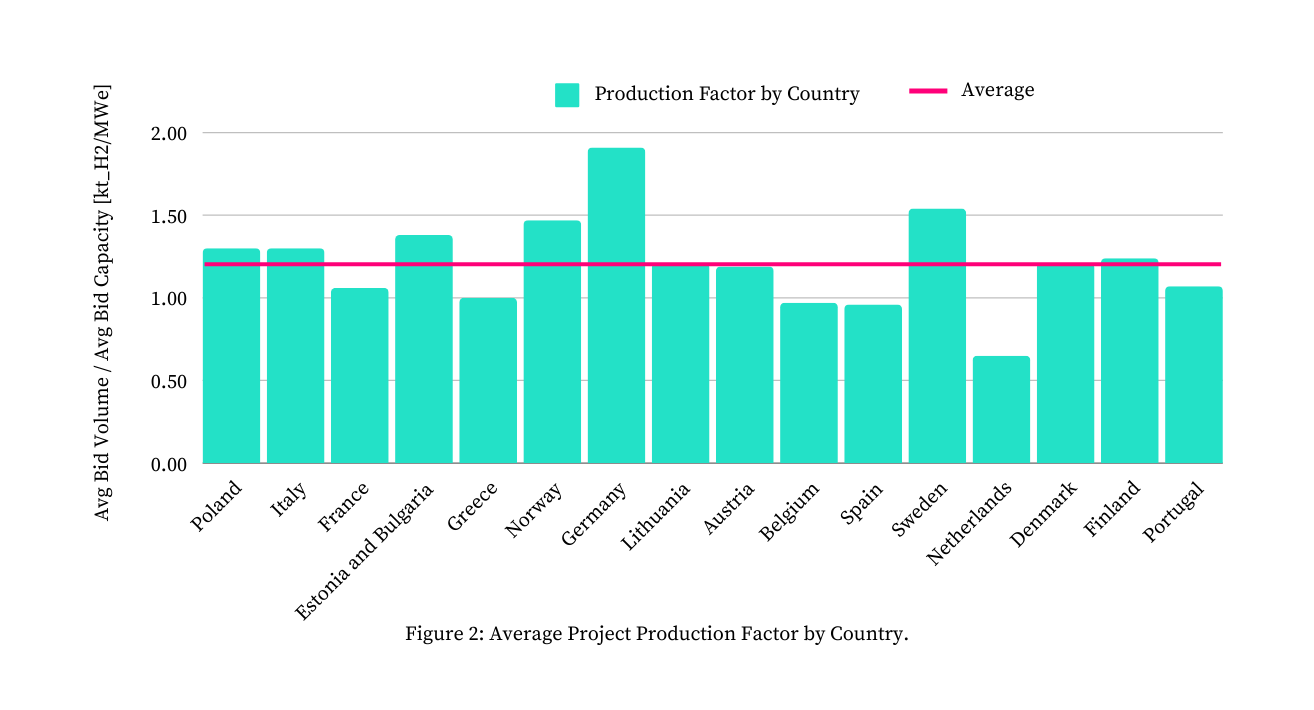

The European Commission also segmented the European hydrogen auction results by country, offering insights into project characteristics. Table 1 below includes published figures and three additional indicators: Average Bid Capacity, Average Bid Volume, and Production Ratio.

Main figures of the European Hydrogen Auction by country. Reference: European Commission

From this data, we found the average LCOH for the 130 projects was 8.35 €/kg. LCOH and average capacity varied significantly by country. However, regarding the Production Factor, Germany and the Netherlands exhibit a notable deviation from the average value. The variation regarding LCOH might be explained by regional differences in available power sources, particularly the integration of stable renewable power like hydro, if projects are commissioned before 2028.

Looking ahead to the next European Hydrogen Auction

Encouraged by the success of this first European hydrogen auction, the European Commission has confirmed a second auction set for the last quarter of 2024. Key proposed changes include:

- Reducing the maximum bid price from 4.5 €/kg to 3.5 €/kg.

- Shortening the commissioning period from five to three years.

- Increasing the completion guarantee from 4% to 10% of the requested grant amount.

- Adding a specific budget item for projects involving maritime sector off-takers.

- Enhancing the detail required in project proposals, particularly concerning the origin and value chain of the electrolyzers, to support decisions aligned with the Net Zero Industry Act (NZIA).

Southern Lights is a software that enhances its customers’ ability to design and optimize proposals for the auctions including Power-to-X alternatives at a fraction of the cost and time it takes energy companies to do this manually, using our intuitive software interface.

If you are interested in understanding how Southern Lights can enable your teams to prepare business designs and project proposals for future European hydrogen auctions optimizing project design for profitability since its early concept, you are always welcome to book a consultation with us.