The European Hydrogen Bank (EHB) represents a significant step forward in accelerating Europe’s transition to green energy by supporting renewable hydrogen production. This initiative aims to close the price gap between renewable and grey hydrogen, fostering sustainable investment across the continent. As a project developer, understanding how to navigate this opportunity can be the difference between a winning and losing proposal.

This article offers an in-depth guide on the EHB’s auction process, tips for preparing a competitive bid for the second round, and strategies for optimizing your hydrogen project.

This is the European Hydrogen Bank auction

The European Hydrogen Bank is a financing instrument established by the European Commission to support the development and growth of the renewable hydrogen industry. Unlike a traditional bank, its primary goal is to facilitate investment in renewable hydrogen production, which is an integral part of Europe’s vision for a greener future. The funding for this initiative comes from the European Emission Trading System (ETS), which channels taxes collected on greenhouse gas emissions into the development of green technologies.

The key objective of the second auction (taking place in winter 2024/2025) is to bridge the price gap between renewable hydrogen and its more carbon-intensive counterpart, grey hydrogen. It aims to accelerate the growth of the green hydrogen industry across Europe, providing an opportunity for project developers to obtain financial support and contribute to the decarbonization of various industries.

The European Hydrogen Bank auction process

The European Hydrogen Bank auction is designed to provide funding for renewable hydrogen projects that demonstrate economic viability, scalability, and a clear pathway to production. The auction process is highly competitive, with the goal of rewarding projects that request the smallest subsidy while meeting strict regulatory and technical standards.

The auction targets primarily project developers. However, it has an impact on the industry that spread to a wide range of stakeholders across the green hydrogen value chain, including electrolyzer manufacturers, engineering companies, construction companies, and off-takers of Renewable Fuels of Non-Biological Origin (RFNBO).

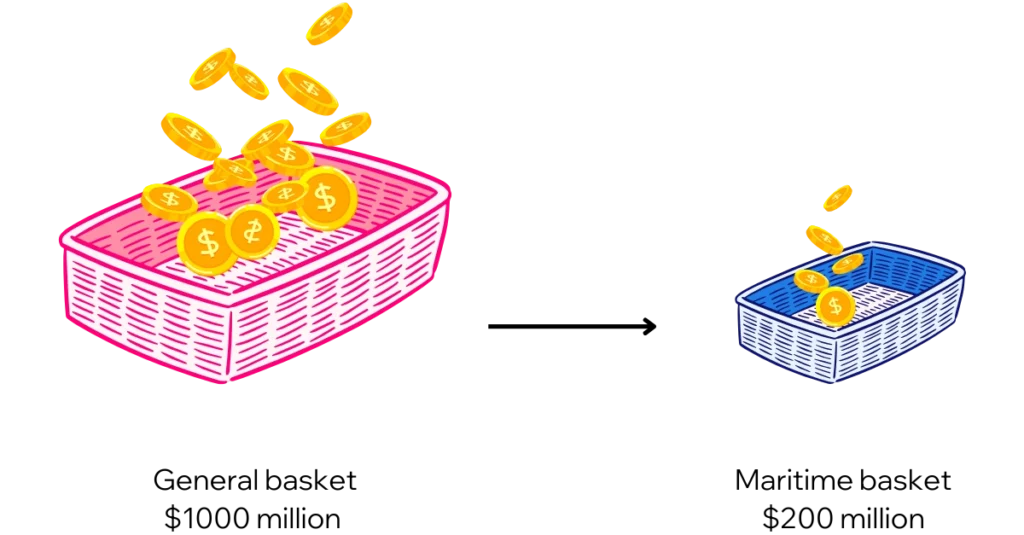

This second auction’s total budget is €1.2 billion, and a specific allocation budget of €200 million is reserved for maritime off-takers. To ensure that funding supports European industries, only projects operating within the European Economic Area (EEA) are eligible, thereby fostering local industry growth.

Budget allocation for the Second European Hydrogen Bank auction is $1000 million in total, where $200 million is reserved for maritime off-takers

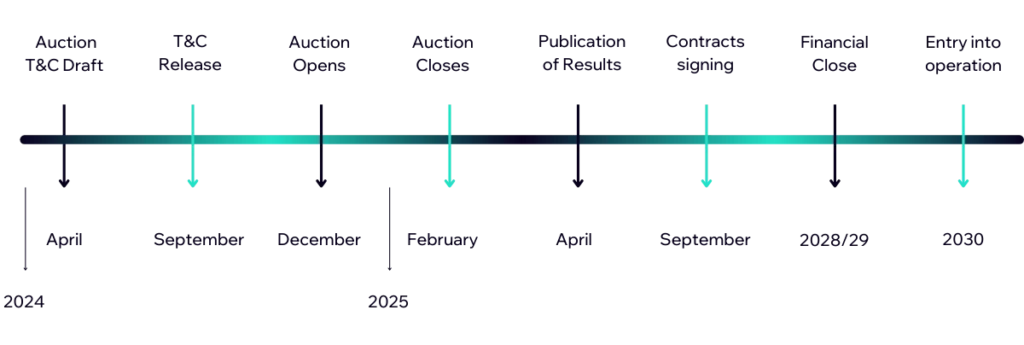

Estimated timeline and key milestones

Since only the auction opening date has been defined, all dates from December 2024 onwards are an estimation based on the previous auction process.

2024:

- April: Auction T&C draft

- September: T&C Release

- December: The auction opens

2025:

- February: The auction closes

- April: Publication of results

- September: Contracts signing

The financial close is estimated for some time in 2028/2029, and the entry into operation is set for 2030.

Eligibility and requirements

To participate in the EHB auction, projects must meet the following criteria:

- Location: Projects must be based within the European Economic Area (EEA), ensuring that the funding supports European industries and contributes to local economies.

- Project maturity: Projects need to demonstrate a certain level of maturity, evidenced by pre-contractual agreements covering at least 60% of their energy supply and hydrogen offtake. This requirement ensures that projects are well-prepared and have a clear path to execution.

- Environmental permitting: Projects must have initiated their permitting processes, including environmental and grid connection permits. This step ensures that projects are ready to move forward once funding is secured.

- Electrolyzer: A new minimum electrolyzer capacity of 5 MW is required, ensuring that only projects capable of making a meaningful contribution to renewable hydrogen production are considered. Additionally, projects have to limit the sourcing of electrolyzer stacks from China to not more than 25%.

Preparing a competitive proposal: what do think about

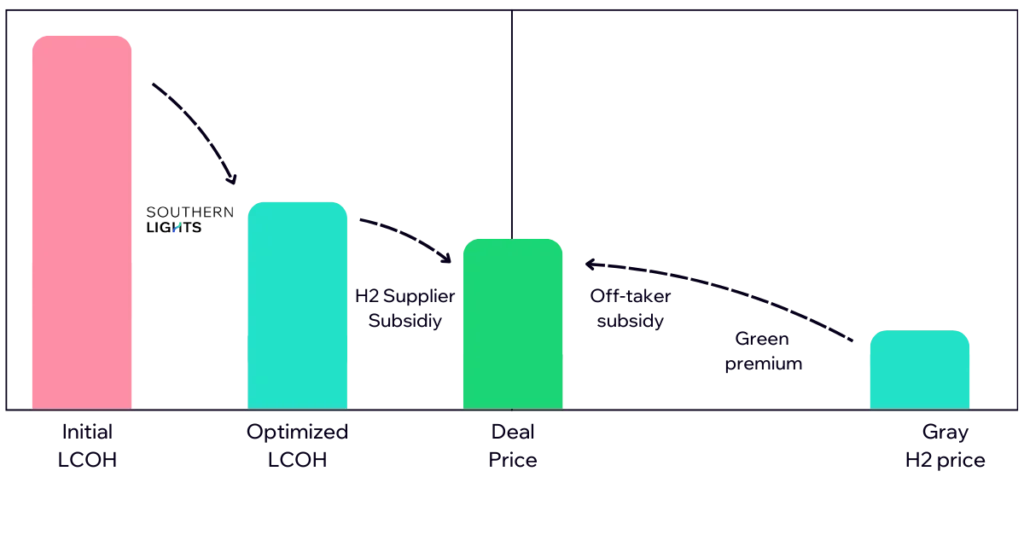

The subsidy aims to bridge the gap between your production costs and the price off-takers are willing to pay. For instance, if your production cost is €3/kg, but off-takers offer €2/kg, your subsidy bid should cover the €1 difference. The maximum bid is capped at €3.5/kg, so optimizing below this threshold significantly improves your chances.

To succeed, it’s essential to understand the European Hydrogen Bank’s two-stage selection process, which ensures only the most promising projects receive funding.

Stage 1 – Admissibility and Eligibility: Projects undergo a pass/fail evaluation based on their maturity, adherence to bid price limits, initiated permitting processes, and overall feasibility.

Stage 2 – Ranking and Selection: Projects that pass the initial assessment are ranked based on their bid price, with the projects with the smaller bids prioritized, until the budget is fully allocated.

Reading tips: Green Ammonia Production in Patagonia: A Prefeasibility Study

Looking at the previous auction, we can draw some conclusions on what makes a successful bid. With the first auction’s winning bids all under €0.50/kg, a crucial and natural approach is to optimize production costs. However, the price gap can also be reduced from the off-taker side, by the will to pay a “green premium” extra, as well as due to off-taker compatible subsidies.

What you can do to lower the price is to carefully analyze your costs. Break down the full cost structure, including CAPEX and OPEX, and maintenance costs. If you are not sure how to do this, you can always use a hydrogen development software. Since energy prices have a major impact on hydrogen production costs, you should also focus on securing cost-effective energy sources, possibly through long-term agreements with renewable energy suppliers.

To increase bid attractiveness, aim for a smaller subsidy by presenting a clear pathway to economic viability. Consider optimizing production methods or integrating technology that can lower costs. You also need to understand how changes in energy prices, demand, or operational costs affect your financial model. This allows you to build a robust project that is resilient to cost fluctuations, increasing confidence in your bid.

You should also begin environmental and grid connection permits as early as possible, and document this progress in your proposal. This shows that you’re ready to hit the ground running and have anticipated regulatory requirements. Outline a realistic timeline with detailed milestones, from construction to commissioning and operation. This provides assurance that the project can meet expected deadlines.

Furthermore, the project needs to comply with the Renewable Fuels of Non-Biological Origin (RFNBO) requirements. These include the use of new electrolyzers and sourcing renewable power, among other elements. Document how your project meets each of these criteria to avoid delays.

And lastly, remember that hydrogen regulations can evolve, so make sure to stay updated on any changes in emissions standards, certifications, and permits. Ensuring your project aligns with the latest regulations reduces risk and strengthens your bid.

Develop an effective energy supply strategy

A competitive hydrogen project requires not just technical expertise but also strategic planning, stakeholder engagement, and optimization. As mentioned previously, an effective energy supply strategy is crucial for reducing costs and ensuring profitability.

- Balancing energy sources: Evaluate the mix of renewable energy sources (solar, wind, grid electricity) that is in line with your project’s operational profile. For instance, 24/7 electrolyzer operation may lower capital expenditure per hydrogen unit but could increase electricity costs.

- Managing load factors: Aligning electrolyzer operations with peak renewable energy generation can enhance efficiency and reduce hydrogen-specific costs, necessitating advanced modeling and forecasting.

Consider electrolyzer selection and sizing

Choosing and sizing the right electrolyzer technology is vital for cost-effectiveness. First of all, you need to investigate which electrolyzer that fits your project. Understand the advantages and disadvantages of technologies like PEM, alkaline and solid oxide, and how they fit with your energy profile. You also need to consider performance degradation over time when planning electrolyzer capacity and maintenance.

Reading tips: Tackling Uncertainty in Green Hydrogen and BESS Projects

Challenges and key considerations

There are certain challenges and things you need to take into consideration. The first point regards permitting and regulatory compliance; Securing permits is often time-consuming. Begin this process early and collaborate closely with regulatory authorities to understand requirements, reducing potential delays.

The second thing you need to consider is the off-taker; you need to engage off-takers that are willing to pay a premium for green hydrogen. This strengthens your project’s market position and chances of securing funding.

This brings us to the final point: Financing and risk management. Hydrogen projects are capital-intensive. Establish a solid financial model, exploring options like equity, debt, and government grants, and develop a risk management strategy for market, regulatory, and technical challenges.

Insights from the first European Hydrogen Bank auction

The first auction, which we have discussed in this article, provides valuable lessons. Over 130 bids were submitted, and winning bids were below €0.5 per kilogram, highlighting the need for highly competitive pricing. Projects with involved off-takers were more successful, as they demonstrated a clearer understanding of market demand and price expectations.

Transparent documentation and standardized reporting also set successful projects apart. Ensuring that your proposal is clear, auditable, and adheres to EHB requirements will greatly enhance your chances of success.

Conclusion

The European Hydrogen Bank auction presents a transformative opportunity for project developers to secure funding for renewable hydrogen initiatives. However, the process is highly competitive, and only projects that demonstrate maturity, cost-effectiveness, and a deep understanding of market needs will succeed.

To maximize your chances, focus on building strong relationships with off-takers, optimizing your energy supply strategy, selecting the right electrolyzer technology, and ensuring your project is financially and regulatory ready. By taking these steps, your project will be positioned as a credible, viable contender in the auction.

We can help you

Do you find the European Hydrogen Bank auction process complicated? Do you struggle to find your perfect electrolyzer for your project? Do not despair. Southern Lights have developed an intelligent software for hydrogen project development; our product offers a complete a toolkit for the design, simulation and feasibility assessment of green hydrogen projects.

It is also great for preparing proposals for hydrogen auctions, since it helps you to identify early-stage costs and metrics that are necessary for participation. If this is what you are looking for, do not hesitate to contact us and see how we can help you to project success.