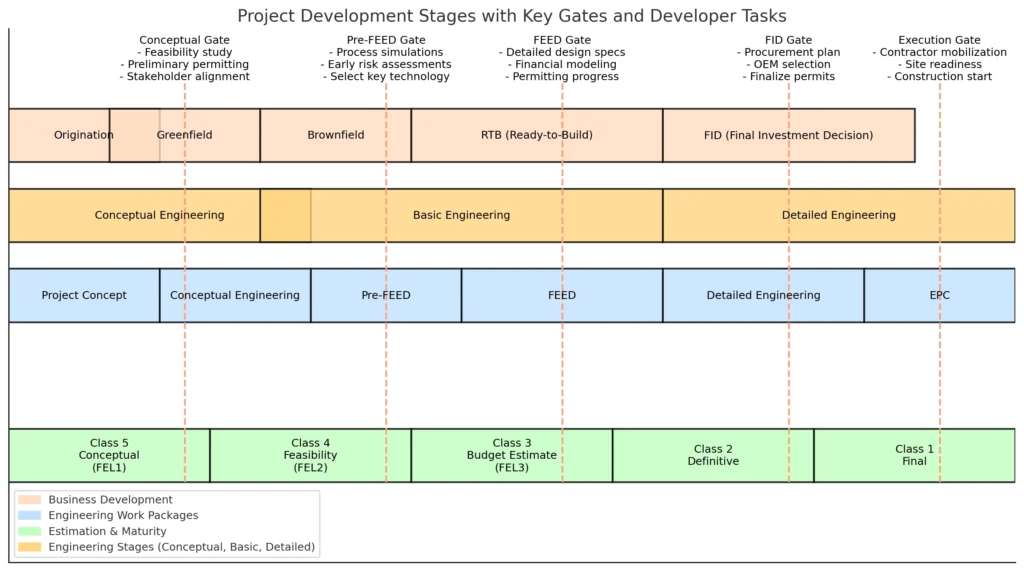

The renewable energy infrastructure market has come a long way. From origination to greenfield, and ultimately to ready-to-build, each project follows a well-trodden path through pre-feasibility, feasibility, FEED, and engineering phases. The end goal is the Final Investment Decision (FID), and in today’s market, that decision increasingly depends on securing an off-taker as merchant projects are rarely viable.

However, not all renewable technologies are on equal footing. Solar and wind are mature markets with established pathways and fewer surprises. For newer technologies like battery energy storage (BESS) and green hydrogen, uncertainty still dominates—making the need for effective project co-pilots even more critical.

Familiar territory in solar and wind

In solar and wind, developers operate in a well-mapped landscape. Large portfolios, multiple players, and a thriving project resale market at various stages of development create a robust pipeline. Even for “Ready to Build” projects, due diligence is an expected part of the process, with known checklists to identify standard risks. Uncertainty, in these cases, is just part of the landscape, contained within predictable boundaries.

Take solar CAPEX costs: they may fluctuate based on module prices or transportation, but this cost uncertainty remains within a manageable threshold. Likewise, performance risks—like degradation rates, efficiency, and operational costs—are manageable. Decades of field data give project developers a solid grasp on expected performance, and insurance markets are well-equipped to hedge these variables. Here, risk is less about the unknown and more about balancing known factors.

Developers in these mature markets face limited risk with clear regulatory, market, and financial structures in place. Regulation changes can be disruptive, but developers understand where the risk is coming from.

You may also like: Power-to-X: Challenges and possibilites in project development

Navigating uncharted waters with BESS and green hydrogen

Battery energy storage (BESS) and green hydrogen are different animals. In the BESS market, cost uncertainty alone is substantial. Pricing varies dramatically between providers, regions, and volumes, with limited data available compared to solar or wind. Beyond cost, performance metrics—round trip efficiency, depth of discharge, sensitivity to environmental factors—are still evolving, creating additional layers of risk. For investors, understanding these risks demands a level of scrutiny that’s more intensive and often harder to quantify than for other technologies.

Green hydrogen, however, takes complexity up another level. Developers entering this sector find themselves grappling with substantial unknowns in everything from electrolyzer costs to lifetime performance and degradation rates. Planning an economically viable hydrogen project requires more than just estimating CAPEX or OPEX; it requires a nuanced understanding of each variable’s range of uncertainty and impact on the overall project.

Not only is the total uncertainty of the project relevant but most crucially to understand how it originates so we can act on it to reduce it as our projects move along the funnel.

For example, when assessing electrolyzer costs, developers can’t afford to rely on a single price point. Instead, they need ranges with defined confidence levels, like “60% confidence that Ex-works electrolyzer costs will fall between 600-900 USD/kW for 100MW scale.” With these benchmarks, developers can calculate KPIs such as LCOH, NPV, and IRR within predictable ranges and establish a path forward in early stages.

Moreover, knowing which inputs contribute most to overall project uncertainty—like “30% linked to power source inputs” or “16% to electrolyzer cost”—helps teams target efforts to reduce risk where it matters most.

Beyond simply identifying main contributors to LCOH, developers must understand where uncertainty lies within these inputs. Most recognize energy cost as a major factor, but does the uncertainty stem from electrolyzer efficiency, the load factor, or fluctuating energy prices? Reducing these uncertainty ranges is critical as projects progress from one maturity stage to the next. Each phase represents a gated process where developers must unlock budget based on the insights gathered to reduce risks and develop a viable path toward profitability. Making these decisions with a clear understanding of risk isn’t just preferable – it’s essential.

Southern Lights: Your co-pilot in uncertainty management

This is where Southern Lights steps in as more than just a software provider. We give energy developers the tools to handle technical and economic uncertainties with precision, independence, and agility. Our platform merges state-of-the-art modeling, exclusive technology datasets, and an AI-powered analytics layer, empowering your team to create reliable prefeasibility studies and risk assessments in minutes rather than weeks.

With Southern Lights, you don’t just get answers – you gain insights into where your project needs focus, automatically optimizing variables to bring risk in line with project targets. We train your team to use the platform, equipping them with the skills to independently control and steer project planning from start to finish. This autonomy is key for our customers, many of whom are energy developers frustrated with the heavy costs, reliance on consultants, and limited control over project timelines.

Our ideal customers are those who value transparency, agility, and a hands-on approach. They seek more than just another tool; they want a partner in navigating the complex waters of green hydrogen and newer markets where risks are still being mapped. And while our software is designed to give your team full control, we recognize that some projects need extra support. Whether through strategic advice, feasibility studies, or targeted consultancy, our experts are here to back you up, whenever and however you need it.

At Southern Lights, we believe that enabling energy developers to manage uncertainty with precision is essential to accelerating green hydrogen adoption. Our mission is to ensure that technology is not a barrier to development but an enabler, accessible to all who want to build a more sustainable energy future.

While the world of renewable energy is changing, we don’t just support your project – we co-pilot your development with a mix of software-driven insight and industry expertise, helping you make smarter, faster, and more effective decisions every step of the way.